Navigating The Patchwork: A Comprehensive Guide To State Sales Tax Maps

Navigating the Patchwork: A Comprehensive Guide to State Sales Tax Maps

Related Articles: Navigating the Patchwork: A Comprehensive Guide to State Sales Tax Maps

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Patchwork: A Comprehensive Guide to State Sales Tax Maps. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Patchwork: A Comprehensive Guide to State Sales Tax Maps

_0.png)

The United States boasts a complex tapestry of state and local taxes, with sales tax playing a pivotal role in funding public services. Understanding this intricate system, particularly the varying rates across states, is crucial for businesses and consumers alike. This guide delves into the intricacies of state sales tax maps, exploring their significance, functionalities, and practical applications.

The Essence of State Sales Tax Maps

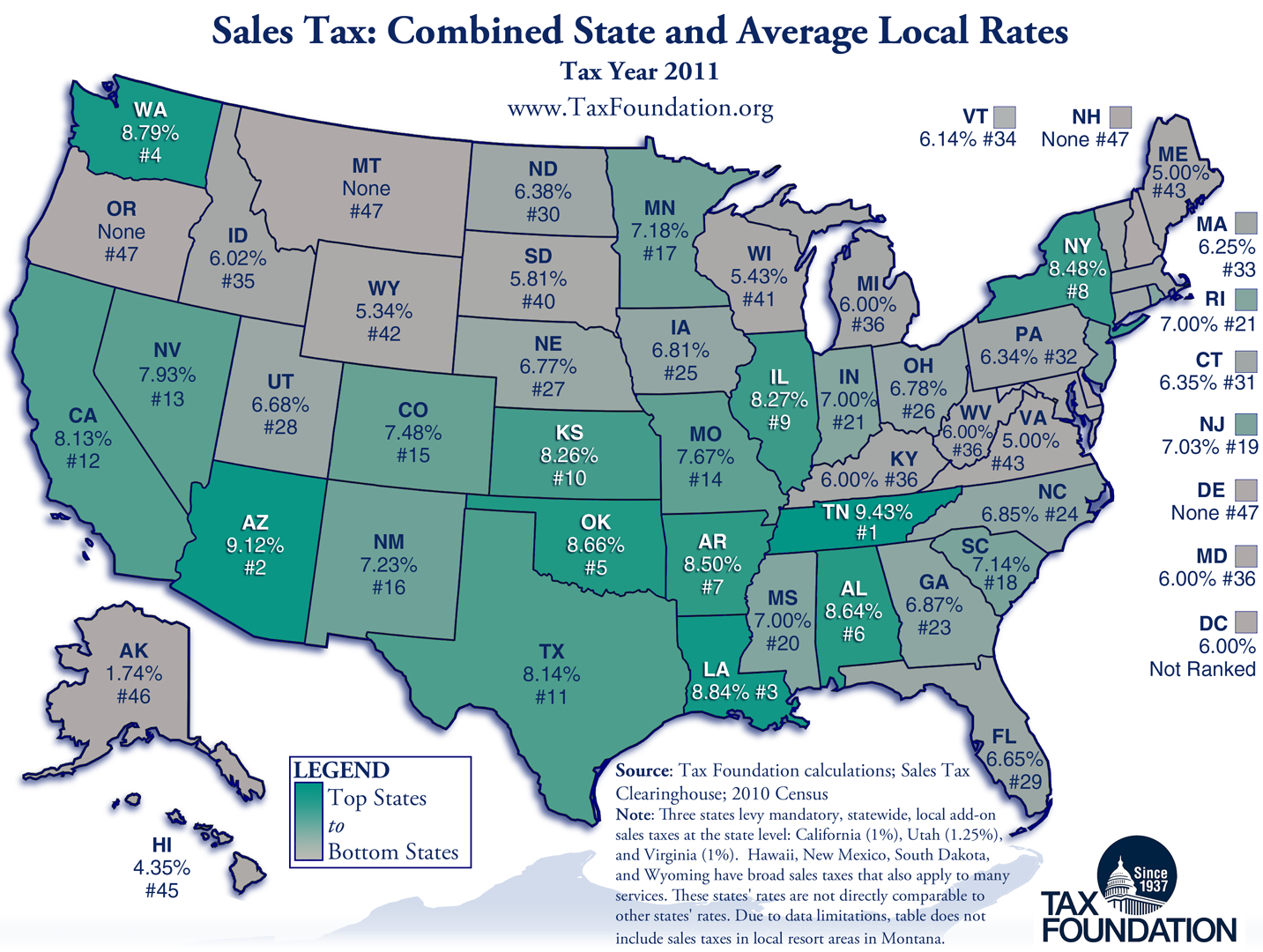

State sales tax maps are visual representations of the sales tax rates levied across different regions within a state. These maps typically depict counties, cities, or even specific districts, highlighting the diverse tax burdens imposed on consumers and businesses. The color scheme often represents different tax rate bands, providing a quick and intuitive understanding of the tax landscape.

Benefits of State Sales Tax Maps

State sales tax maps offer several advantages:

- Transparency and Clarity: They provide a straightforward and readily understandable visual representation of sales tax rates, eliminating the need to sift through complex tax codes.

- Informed Decision-Making: Businesses can leverage these maps to strategize pricing, inventory management, and distribution, ensuring competitive advantage in different markets.

- Consumer Awareness: Consumers can utilize these maps to compare prices across different locations, making informed purchasing decisions and optimizing their spending.

- Compliance Assistance: Businesses can utilize these maps to ensure accurate tax reporting and avoid potential penalties.

- Policy Evaluation: State and local governments can use these maps to assess the effectiveness of tax policies and identify areas requiring adjustments.

Navigating the Map: A Step-by-Step Guide

Understanding the intricacies of a state sales tax map requires a systematic approach:

- Identify the Geographic Scope: Determine the specific region covered by the map, whether it encompasses the entire state, individual counties, or specific cities.

- Understand the Color Legend: Familiarize yourself with the color scheme used to represent different tax rates. Each color typically corresponds to a specific tax rate band.

- Locate the Area of Interest: Pinpoint the specific location on the map for which you require sales tax information.

- Identify the Applicable Rate: Based on the color associated with your location, determine the corresponding sales tax rate.

- Consider Additional Taxes: Be mindful of any additional taxes that may apply, such as local option taxes or special district levies.

Examples of State Sales Tax Maps

Many states offer publicly accessible sales tax maps on their official websites or through dedicated tax information portals. Here are some examples:

- California: The California Department of Tax and Fee Administration (CDTFA) provides an interactive map that allows users to search by address or zip code to identify the applicable sales tax rate.

- Texas: The Texas Comptroller of Public Accounts offers a downloadable sales tax rate map that depicts the varying rates across counties and cities.

- New York: The New York State Department of Taxation and Finance provides a comprehensive sales tax rate map that includes information on local sales tax rates.

FAQs on State Sales Tax Maps

Q: Can I find the sales tax rate for a specific address using a state sales tax map?

A: Yes, most state sales tax maps allow users to search by address or zip code to identify the applicable rate.

Q: Are there any exceptions to the sales tax rates displayed on the map?

A: Yes, certain items may be exempt from sales tax, and some industries may have special tax rates. It’s essential to consult the state’s tax code for specific exemptions and exceptions.

Q: How often are state sales tax maps updated?

A: State sales tax maps are generally updated periodically to reflect changes in tax rates or legislative amendments. It’s advisable to consult the official source for the most up-to-date information.

Q: Are state sales tax maps free to use?

A: Yes, most state sales tax maps are accessible free of charge on official government websites or through dedicated tax information portals.

Tips for Utilizing State Sales Tax Maps

- Verify Information: Always double-check the information provided on the map with the official state tax code or website to ensure accuracy.

- Consider Local Taxes: Be aware that additional local taxes may apply beyond the state sales tax rate.

- Stay Updated: Regularly monitor state tax updates and changes to ensure your information remains accurate.

- Consult Tax Professionals: For complex sales tax situations, it’s advisable to consult with a qualified tax professional.

Conclusion

State sales tax maps serve as invaluable tools for navigating the intricate world of sales tax, providing transparency, clarity, and informed decision-making for businesses and consumers alike. By understanding the structure, features, and applications of these maps, individuals and businesses can effectively manage their tax obligations, optimize their purchasing decisions, and navigate the complex tax landscape with greater confidence. As the tax landscape evolves, staying informed and utilizing these resources will remain crucial for successful financial management.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Patchwork: A Comprehensive Guide to State Sales Tax Maps. We thank you for taking the time to read this article. See you in our next article!