Navigating The USDA Loan Landscape In Florida: A Comprehensive Guide

Navigating the USDA Loan Landscape in Florida: A Comprehensive Guide

Related Articles: Navigating the USDA Loan Landscape in Florida: A Comprehensive Guide

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the USDA Loan Landscape in Florida: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the USDA Loan Landscape in Florida: A Comprehensive Guide

The United States Department of Agriculture (USDA) offers a variety of loan programs designed to promote rural development and homeownership. One of the most popular programs is the USDA Rural Development Housing Loan, also known as the USDA Loan. This program allows eligible borrowers to purchase, build, or renovate a home in designated rural areas, often with lower interest rates and flexible terms compared to conventional mortgages.

Florida, with its diverse landscape and growing population, presents a unique environment for potential USDA loan borrowers. Understanding the eligibility criteria, application process, and specific benefits of the program within the state is crucial for navigating this pathway to homeownership.

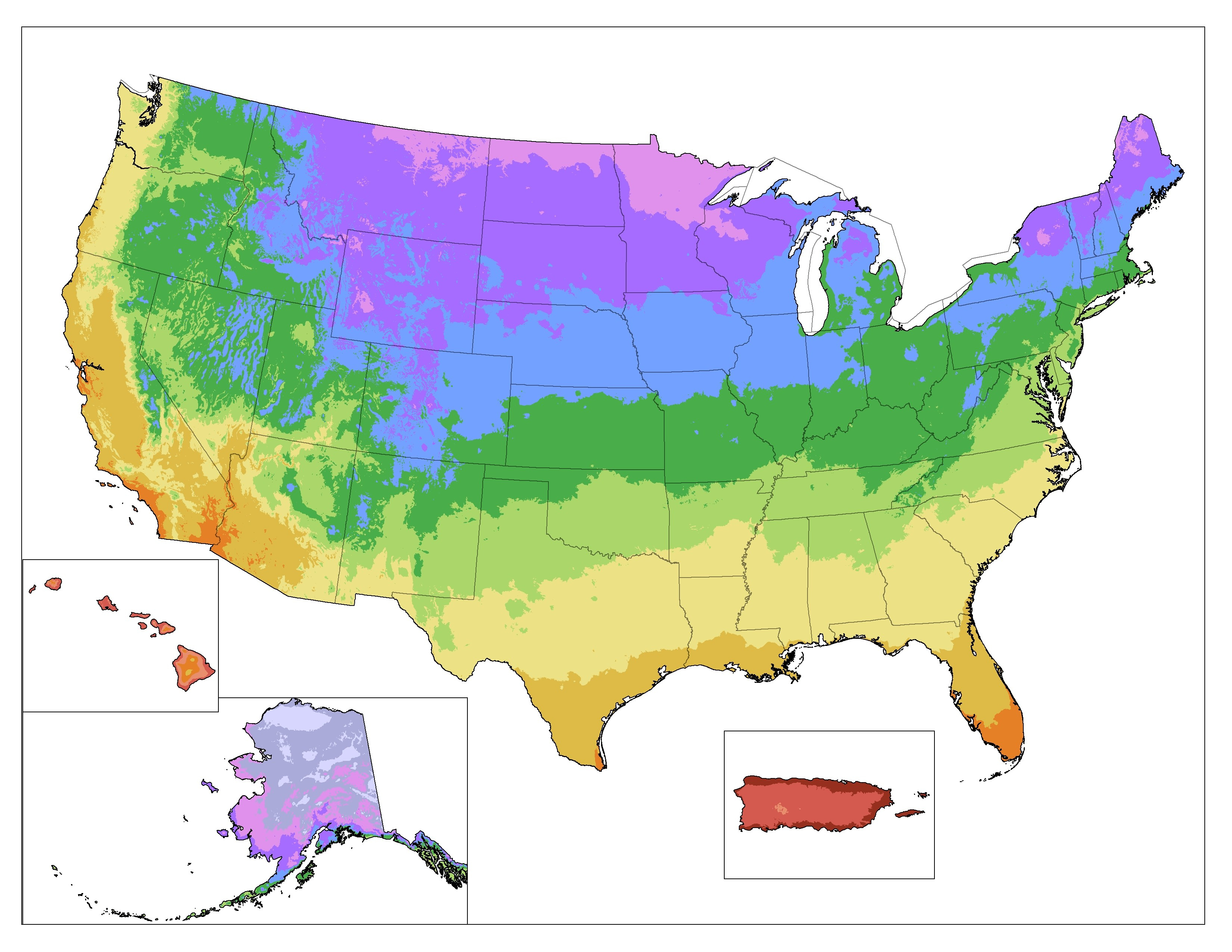

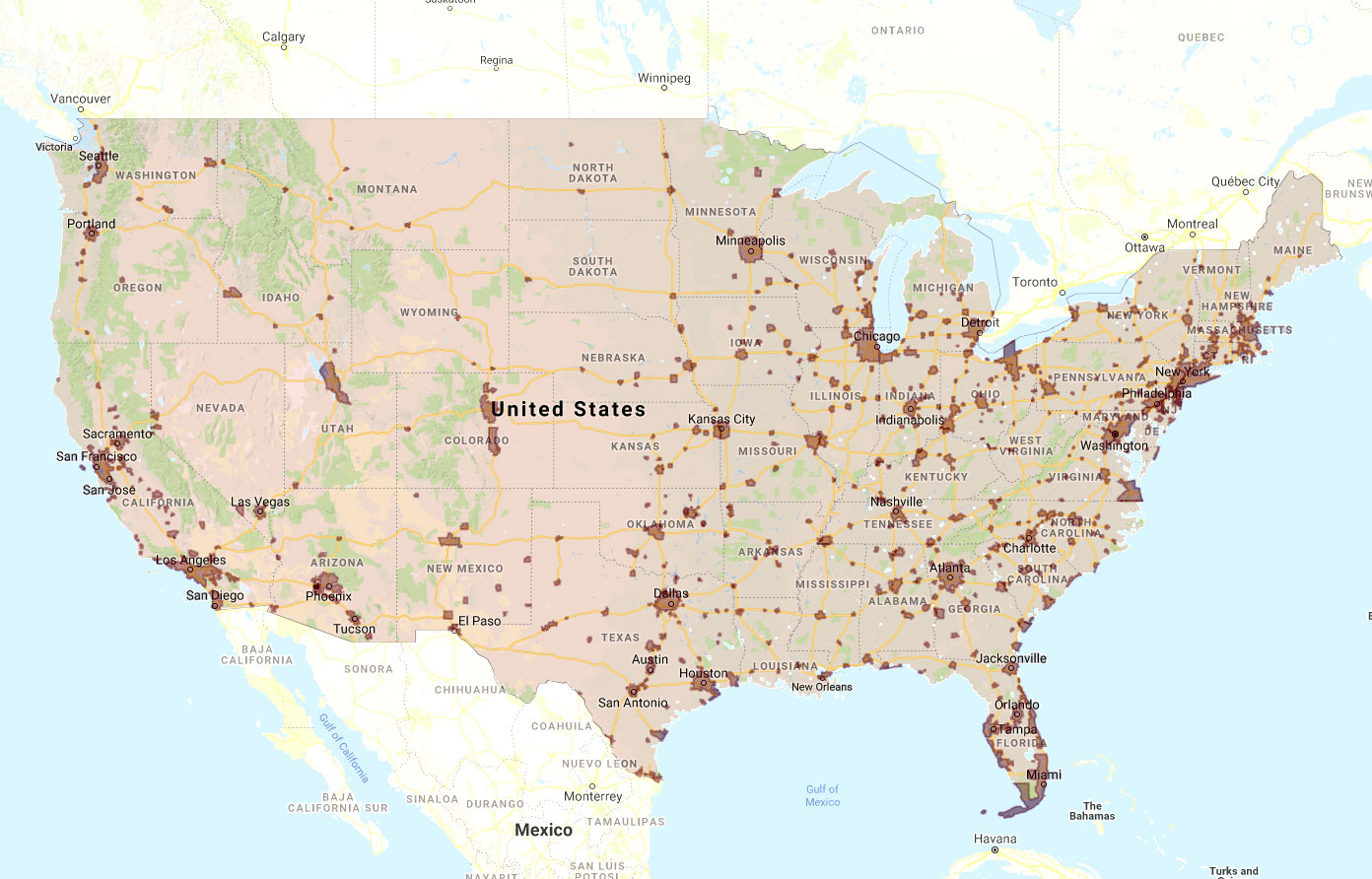

Understanding the USDA Loan Map in Florida

The USDA Loan program is not available in all areas of Florida. The USDA Loan Map is an essential tool for determining eligibility. This interactive map, accessible on the USDA Rural Development website, clearly delineates areas where USDA loans are offered.

What Defines a Rural Area in Florida?

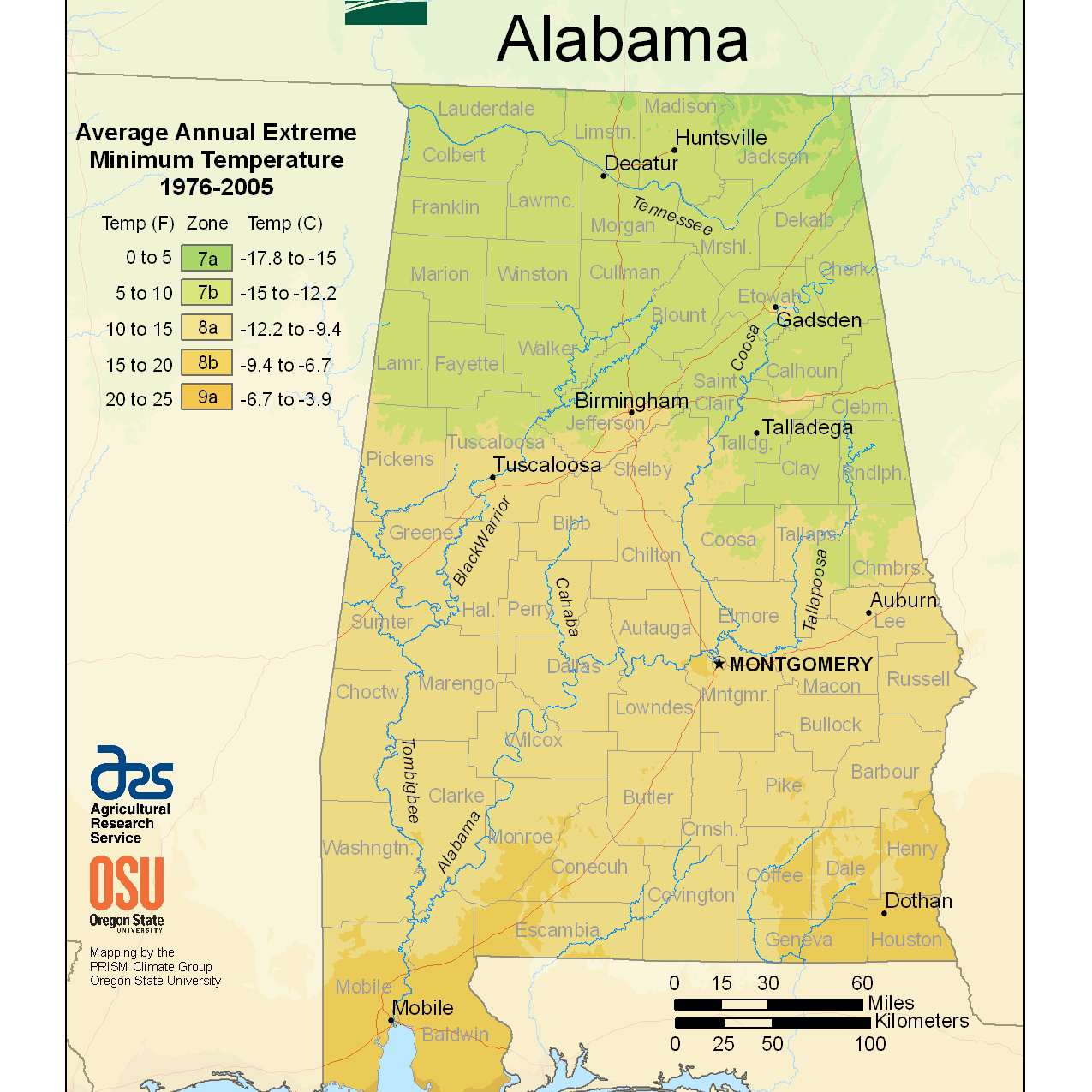

To qualify for a USDA loan in Florida, the property must be located in a designated rural area. This designation is not solely based on population density. The USDA considers various factors, including:

- Population: Areas with populations under 20,000 are generally considered rural.

- Proximity to urban areas: The USDA may consider a location rural even if it is near a larger city, depending on the specific characteristics of the area.

- Economic conditions: The USDA also examines factors like unemployment rates and per capita income to assess the rural nature of an area.

Navigating the USDA Loan Map: A Step-by-Step Guide

- Visit the USDA Rural Development website: Access the USDA Loan Map through the official website of the USDA Rural Development program.

- Select "Florida" as the state: Choose Florida from the dropdown menu to view the map specific to the state.

- Explore the map: The map will display different color-coded areas representing eligible and ineligible regions for USDA loans.

- Zoom in for detail: Utilize the zoom function to pinpoint specific locations within Florida.

- Check property addresses: Enter a specific property address to confirm its eligibility for a USDA loan.

Key Benefits of the USDA Loan Program in Florida

The USDA Loan program offers several advantages for homebuyers in Florida:

- Lower interest rates: USDA loans often have lower interest rates compared to conventional mortgages, leading to significant savings over the life of the loan.

- No down payment requirement: In some cases, borrowers can qualify for a USDA loan with zero down payment, making homeownership more accessible.

- Flexible terms: The USDA offers flexible terms, including longer loan periods, which can lower monthly payments and make the loan more manageable.

- Rural development focus: The USDA Loan program prioritizes rural development, promoting economic growth and community revitalization in designated areas.

Eligibility Criteria for the USDA Loan in Florida

To be eligible for a USDA loan in Florida, borrowers must meet specific requirements, including:

- Residency: The borrower must intend to occupy the property as their primary residence.

- Income: The borrower’s income must fall within USDA guidelines, which vary based on family size and location.

- Creditworthiness: Borrowers must have a satisfactory credit score and a history of responsible debt management.

- Property location: The property must be located within a designated rural area in Florida.

Common Questions about the USDA Loan Map in Florida

1. Can I get a USDA loan in a town that is close to a major city?

While the USDA Loan program generally focuses on rural areas, it is possible to qualify for a loan in a town that is close to a larger city, depending on the specific location and its characteristics.

2. What are the income limits for USDA loans in Florida?

Income limits for USDA loans in Florida vary depending on the location and the size of the household. It is recommended to consult the USDA Rural Development website or contact a local lender to obtain current income limits.

3. What types of properties qualify for USDA loans in Florida?

USDA loans are available for a variety of properties, including single-family homes, townhouses, and condominiums. However, certain types of properties, such as multi-family dwellings, are not eligible.

4. How can I find a lender who offers USDA loans in Florida?

The USDA Rural Development website provides a directory of lenders who participate in the USDA Loan program. You can also contact local real estate agents or mortgage brokers for recommendations.

5. What are the closing costs associated with a USDA loan in Florida?

Closing costs for USDA loans in Florida can vary depending on the lender and the specific property. It is essential to discuss these costs with a lender during the application process.

Tips for Securing a USDA Loan in Florida

- Research eligibility: Use the USDA Loan Map to determine if the property you are interested in qualifies for a USDA loan.

- Check your credit: Improve your credit score before applying for a loan to increase your chances of approval.

- Gather documentation: Prepare all necessary documentation, including income verification, employment history, and asset statements.

- Shop around for lenders: Compare interest rates and terms from multiple lenders to find the best deal.

- Seek guidance from professionals: Consult with a real estate agent and a mortgage broker for expert advice throughout the process.

Conclusion

The USDA Loan program offers a valuable opportunity for homebuyers in Florida, particularly those seeking affordable housing options in designated rural areas. By understanding the eligibility criteria, navigating the USDA Loan Map, and utilizing the program’s benefits, potential borrowers can increase their chances of achieving homeownership. Remember to conduct thorough research, seek professional guidance, and carefully review the terms and conditions of the loan to make an informed decision.

Closure

Thus, we hope this article has provided valuable insights into Navigating the USDA Loan Landscape in Florida: A Comprehensive Guide. We thank you for taking the time to read this article. See you in our next article!