Unlocking Rural Homeownership In Texas: Navigating The USDA Loan Map

Unlocking Rural Homeownership in Texas: Navigating the USDA Loan Map

Related Articles: Unlocking Rural Homeownership in Texas: Navigating the USDA Loan Map

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Unlocking Rural Homeownership in Texas: Navigating the USDA Loan Map. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Unlocking Rural Homeownership in Texas: Navigating the USDA Loan Map

The dream of owning a home is a powerful one, but for many, the financial hurdles can seem insurmountable. In Texas, a state known for its sprawling landscapes and diverse communities, the United States Department of Agriculture (USDA) offers a lifeline to those seeking affordable homeownership in rural areas. This lifeline takes the form of the USDA Rural Development Loan program, a powerful tool for individuals and families seeking to purchase, build, or improve their homes in eligible locations.

The USDA Loan program isn’t just about financing; it’s about empowering communities. By providing affordable financing options, the program fosters economic growth, strengthens rural communities, and ensures that homeownership remains attainable for a wider range of Texans.

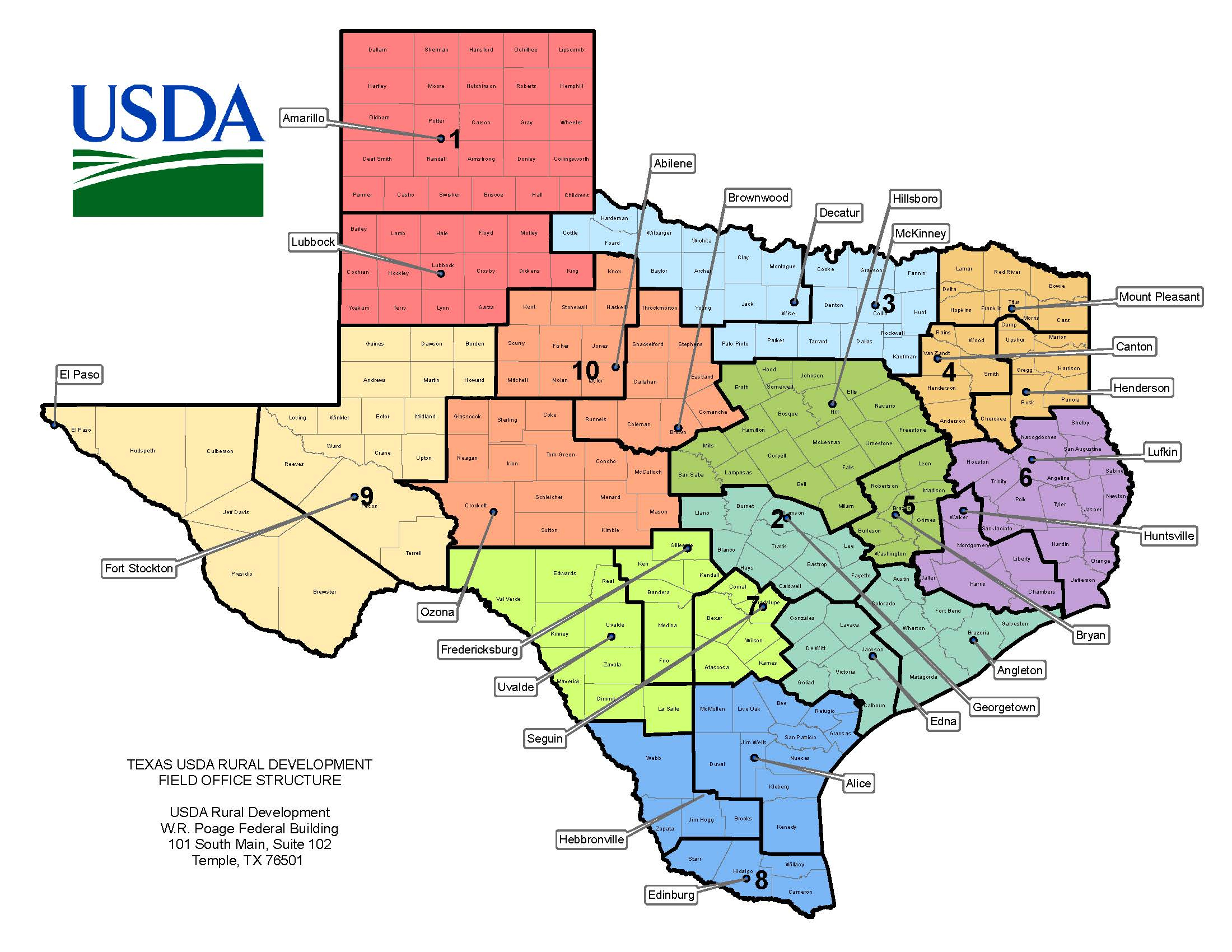

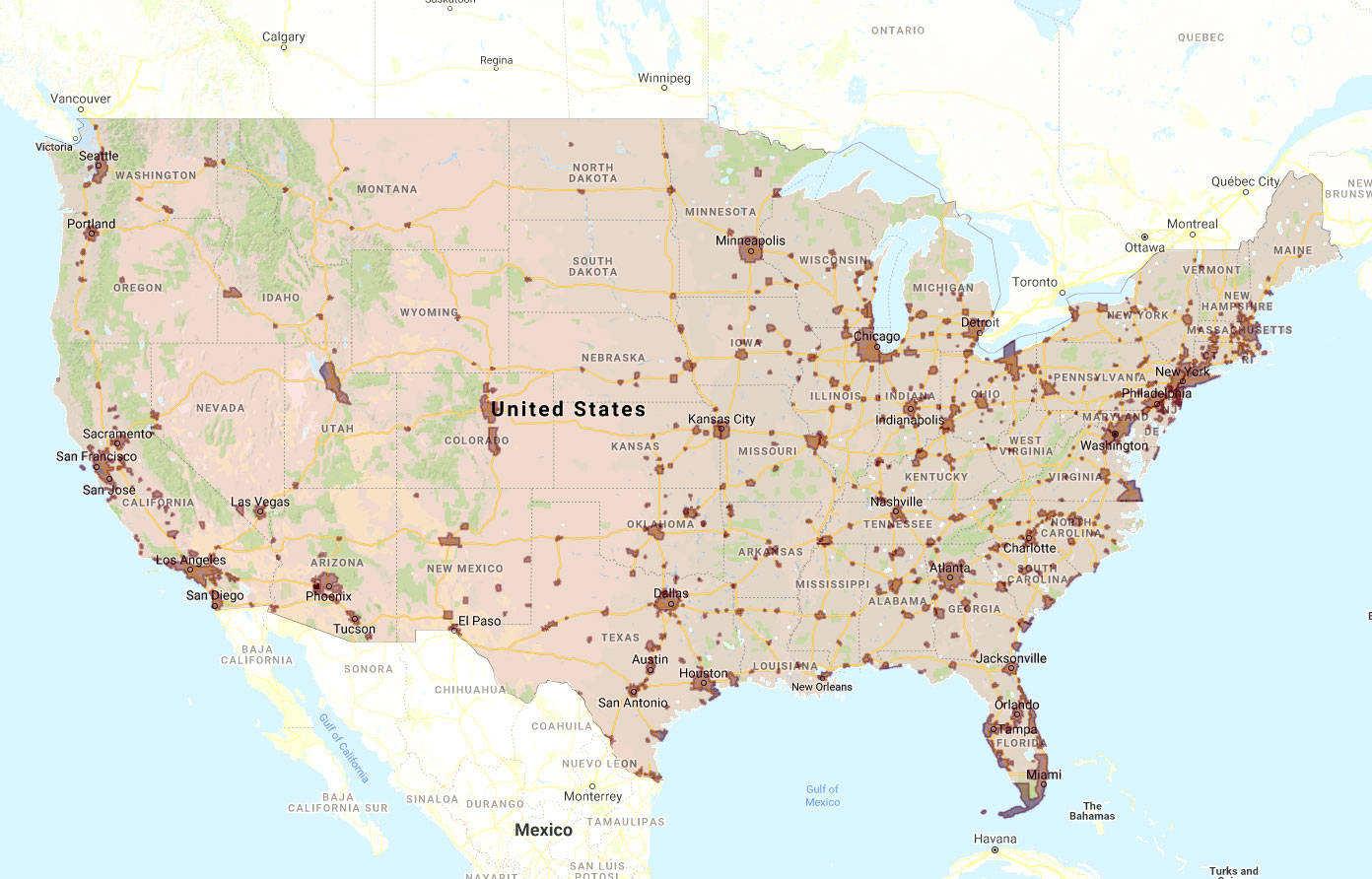

Understanding the USDA Loan Map

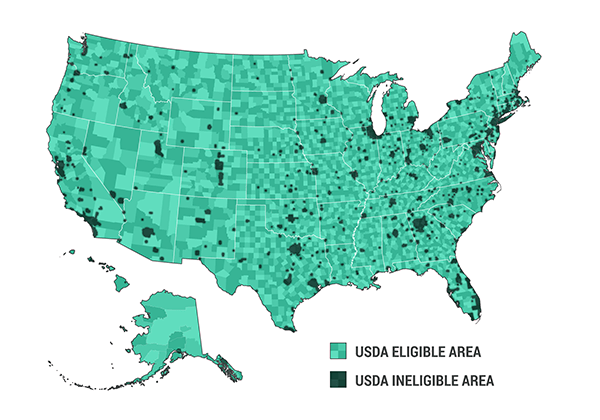

The USDA Loan program is not available in all areas of Texas. To determine eligibility, the program utilizes a map-based system that visually depicts eligible locations. This map, known as the USDA Loan Map, is a crucial tool for potential borrowers. It is essential to understand the map’s intricacies and how it dictates eligibility.

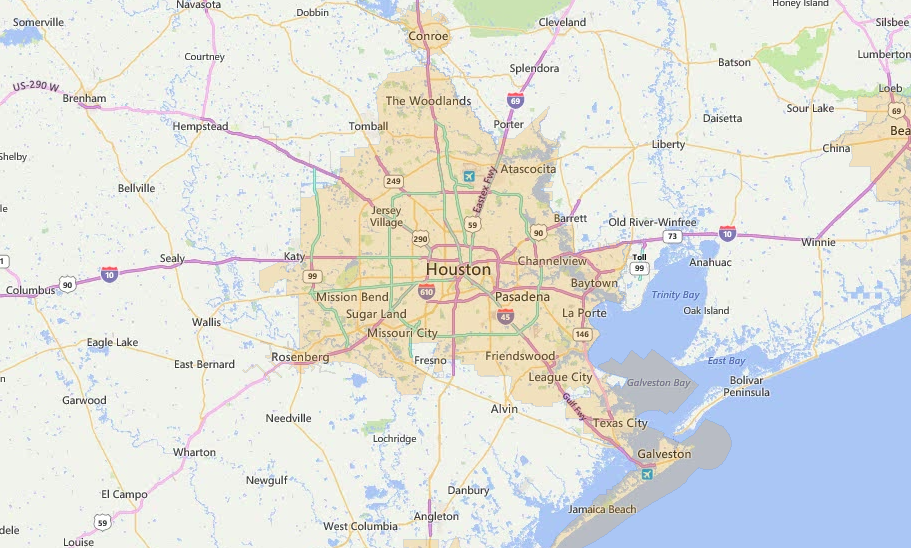

Defining "Rural" in Texas

The USDA defines "rural" areas based on population density and other factors. This definition is not always intuitive, as it can encompass areas that may not appear "rural" to the untrained eye. For example, some suburban areas near major cities may qualify as "rural" under USDA guidelines.

Navigating the USDA Loan Map

The USDA Loan Map is available online and is a valuable resource for potential borrowers. It allows users to input an address or zip code to determine if a specific location qualifies for USDA financing. The map displays eligible areas in green, while ineligible areas appear in gray.

Beyond the Map: Additional Eligibility Criteria

While the USDA Loan Map provides a preliminary assessment of eligibility, it is crucial to remember that the map alone does not guarantee approval. Other eligibility criteria must be met, including:

- Income Limits: Applicants must meet certain income requirements based on the size of their household and the location of the property.

- Credit History: A good credit score and history are essential for loan approval.

- Property Type: The USDA program typically finances single-family homes, but it may also offer financing for multi-family homes, manufactured homes, and even rural business ventures.

- Property Location: The property must be located in an eligible rural area, as defined by the USDA.

The Benefits of USDA Financing

The USDA Loan program offers a number of advantages to eligible borrowers, including:

- Lower Interest Rates: USDA loans often have lower interest rates than conventional loans, making homeownership more affordable.

- No Down Payment: In many cases, USDA loans require no down payment, making homeownership accessible to those with limited savings.

- Flexible Loan Terms: USDA loans offer flexible terms, including longer repayment periods, which can help borrowers manage their monthly payments.

- Community Investment: The program helps to revitalize rural communities by encouraging homeownership and economic growth.

FAQs about USDA Loan Map Texas

Q: What areas in Texas are eligible for USDA loans?

A: The USDA Loan Map is the primary resource for determining eligibility. It visually displays eligible areas in green, with ineligible areas appearing in gray.

Q: How do I find out if my specific address is eligible for a USDA loan?

A: You can use the USDA Loan Map online to input your address or zip code. The map will indicate if your location is eligible.

Q: What are the income limits for USDA loans in Texas?

A: Income limits vary based on the size of the household and the location of the property. You can find specific income limits for your area using the USDA Rural Development website or by contacting a USDA-approved lender.

Q: Do I need a down payment for a USDA loan?

A: In many cases, USDA loans require no down payment. However, there may be closing costs associated with the loan.

Q: What are the credit score requirements for USDA loans?

A: A good credit score is essential for USDA loan approval. The specific requirements may vary depending on the lender.

Q: What types of properties are eligible for USDA financing?

A: The USDA program typically finances single-family homes, but it may also offer financing for multi-family homes, manufactured homes, and even rural business ventures.

Tips for Navigating the USDA Loan Program

- Research Thoroughly: Before applying for a USDA loan, thoroughly research the program’s requirements and eligibility criteria.

- Consult with a Lender: Speak with a USDA-approved lender to discuss your specific financial situation and loan options.

- Gather Necessary Documents: Be prepared to provide documentation, including your income, credit history, and property information.

- Be Patient: The USDA loan process can take time. Be patient and work closely with your lender.

Conclusion

The USDA Loan Map is a powerful tool for individuals and families seeking affordable homeownership in rural Texas. By understanding the map’s intricacies and meeting the program’s eligibility criteria, potential borrowers can unlock the opportunity to build a brighter future in a thriving rural community. The USDA Loan program is not simply a financial tool; it is a catalyst for community growth, economic prosperity, and the realization of the American dream of homeownership.

Closure

Thus, we hope this article has provided valuable insights into Unlocking Rural Homeownership in Texas: Navigating the USDA Loan Map. We appreciate your attention to our article. See you in our next article!